what are all the cryptocurrencies

- Are all cryptocurrencies the same

- Are all cryptocurrencies based on blockchain

- Do all cryptocurrencies use blockchain

What are all the cryptocurrencies

The total crypto market volume over the last 24 hours is $172.65B, which makes a 34.94% increase. The total volume in DeFi is currently $27.22B, 15.77% of the total crypto market 24-hour volume https://greenleafsupplements.com/. The volume of all stable coins is now $161.34B, which is 93.45% of the total crypto market 24-hour volume.

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

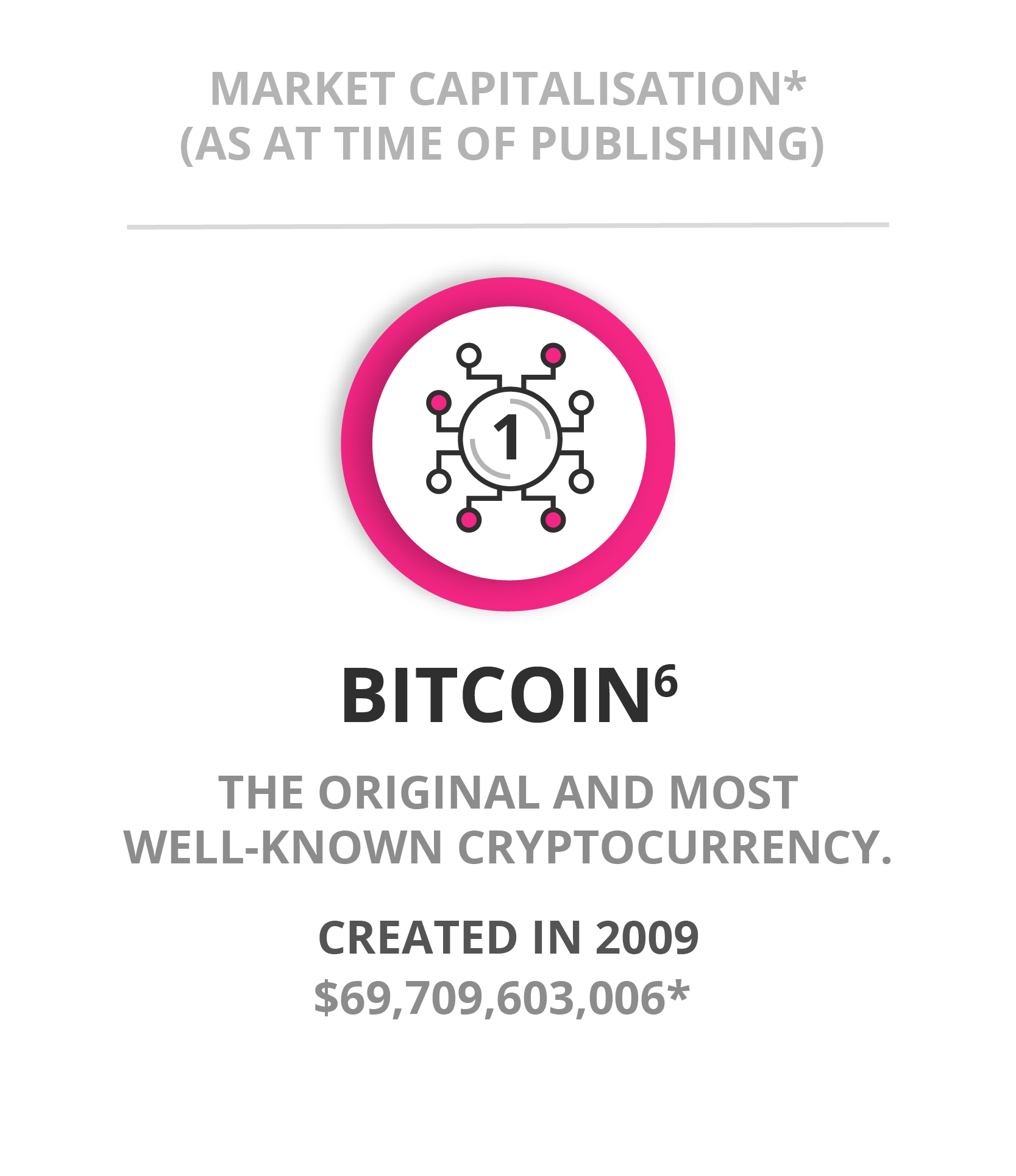

The UK’s Financial Conduct Authority estimated there were over 20,000 different cryptocurrencies by the start of 2023, although many of these were no longer traded and would never grow to a significant size.

Are all cryptocurrencies the same

Unlike other cryptocurrencies, stablecoins are pegged to an asset, such as the U.S. dollar or the euro. And because a stablecoin tracks the pegged asset, its value stays stable relative to the pegged asset. Of course, some stablecoins aren’t pegged to a hard asset and instead maintain stable value by technical means, such as destroying some of the currency supply to generate scarcity. Those are known as algorithmic stablecoins.

Unlike other cryptocurrencies, stablecoins are pegged to an asset, such as the U.S. dollar or the euro. And because a stablecoin tracks the pegged asset, its value stays stable relative to the pegged asset. Of course, some stablecoins aren’t pegged to a hard asset and instead maintain stable value by technical means, such as destroying some of the currency supply to generate scarcity. Those are known as algorithmic stablecoins.

Digital currencies such as CBDCs have the support of the government and are subject to all the relevant financial regulations. Therefore, investors are likely to consider digital currencies as trusted financial instruments. Traditional frameworks backing the legality of digital currencies help people gain their trust.

Past price trends are not indicative of future price trends and are not intended to be a proxy for historical or projected future performance of any specific artwork or Masterworks shares. Also, our materials may present comparisons between the historical price performance of a segment of the art market and other investment asset classes, such as stocks, bonds, real estate, and others. There are important differences between art and other asset classes. For more information, see important disclosures.

First things first: Know the difference between a coin and a token. When discussing cryptos, you may hear the terms “coin” and “token” frequently used. Although they may sound like interchangeable terms, there is a difference. It’s important to keep them straight.

There are other platforms that do not place a limit on the total number of coins to be issued. Like governments minting fiat, these platforms have the ability to continue creating and distributing coins in perpetuity. Some distribute their coins by selling them, while others give them away in exchange for actual work done in support of the project.

Are all cryptocurrencies based on blockchain

On some blockchains, transactions can be completed and considered secure in minutes. This is particularly useful for cross-border trades, which usually take much longer because of time zone issues and the fact that all parties must confirm payment processing.

At the moment, not all DAG-based cryptocurrencies can be bought with fiat currencies like euros and dollars. Most exchanges that support these currencies only allow you to buy them using other cryptocurrencies, like bitcoins or ether. If you don’t already own cryptocurrency, you’ll have to buy some first through one of the relatively few exchanges in the world that allow you to buy cryptocurrencies using your everyday money.

Crypto exchanges, such as those for Bitcoin and Ethereum, are the most common use case for blockchain technology, providing a secure and transparent system for processing and recording transactions. This technology ensures the integrity and accuracy of cryptocurrency transactions, making them resistant to fraud and hacking attempts.

These keys make it easier to complete two-party transactions. They generate a secure digital identification reference and are unique to each user. This brings us to the most important aspect of Blockchain technology. Transactions. They are authorized and managed using this identity. Because simply being able to communicate isn’t enough. You’ll also need to ensure that your communication is unaltered.

Do all cryptocurrencies use blockchain

Teresa Halvorson is a skilled writer with a passion for financial journalism. Her expertise lies in breaking down complex topics into engaging, easy-to-understand content. With a keen eye for detail, Teresa has successfully covered a range of article categories, including currency exchange rates and foreign exchange rates.

Since Bitcoin’s introduction in 2009, blockchain uses have exploded via the creation of various cryptocurrencies, decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and smart contracts.

Cryptocurrencies and blockchain technology are often regarded as the same thing. This makes it seem like a cryptocurrency cannot exist without an underlying blockchain technology. But is this really the case?

Because of the decentralized nature of the Bitcoin blockchain, all transactions can be transparently viewed by downloading and inspecting them or by using blockchain explorers that allow anyone to see transactions occurring live. Each node has its own copy of the chain that gets updated as fresh blocks are confirmed and added. This means that if you wanted to, you could track a bitcoin wherever it goes.

If you have ever spent time in your local Recorder’s Office, you will know that recording property rights is both burdensome and inefficient. Today, a physical deed must be delivered to a government employee at the local recording office, where it is manually entered into the county’s central database and public index. In the case of a property dispute, claims to the property must be reconciled with the public index.

There are no reviews yet.